Savers have been rejoicing over the last year or so. With the Fed raising benchmark rates, CDs, money market funds, and even checking accounts have started to pay some meaningful interest. This has been wonderful news for those seeking income. However, as they say, “No good deed goes unpunished.”

And in this case, we’re talking about taxes.

It’s been a long time since investors have had to think about interest income and taxes with regard to their savings accounts. But after the yield bonanza of the last few years, tax bills are expected to be heavy. But there is a solution that investors may want to consider. Short-term municipal bonds offer safety, liquidity, and income without many of the tax surprises.

High Yields Equal High Taxes

Truth be told, savers haven’t had to think about taxes too much over the last decade or so. In the years of 0.1% yields on cash, many investors and savers fell below the reporting requirements for the IRS. Even if they did receive a 1099 form, the amount was negligible.

However, these days are a bit different. With money market funds now yielding 5%, CDs yielding 4.5%, and even checking accounts paying nearly 3%, investors are starting to get some serious interest on their savings. So it’s no wonder with rates being so high that they’ve plowed a record $5.84 trillion into money market funds.

But with such high rates and all that cash, taxes are looming. And right now, investors are starting to get those bills. The problem is that interest income is taxed at ordinary income rates. That can be as high as 37%. That’s even worse when factoring state taxes.

For example, for an investor in California, at the top federal and state rates (currently 45%), they would pay roughly $2,250 in taxes on a $100,000 money market fund earning 5%. That’s a significant chunk of change.

The Municipal Solution

Higher yields have been a wonderful place for savers. But it’s a double-edged sword, as those higher yields mean more taxes. How do savers manage liquidity and safety while minimizing the tax bite? The answer may be in municipal bonds. Specifically, short-term muni bonds.

Municipal bonds are issued by states and local governments to fund their operations and programs. Uncle Sam, to support these operations, will cut you a break on taxes. Interest from most muni bonds is free from federal taxes. Second, muni bonds are also exempt from the issuing state’s taxes. So, an investor in New York buying New York munis would pay effectively no taxes on the interest.

Like many bonds, munis come in a variety of forms. This includes those on the shorter end of the maturity curve: less than two years. This is where investors can find a win on taxes and liquidity.

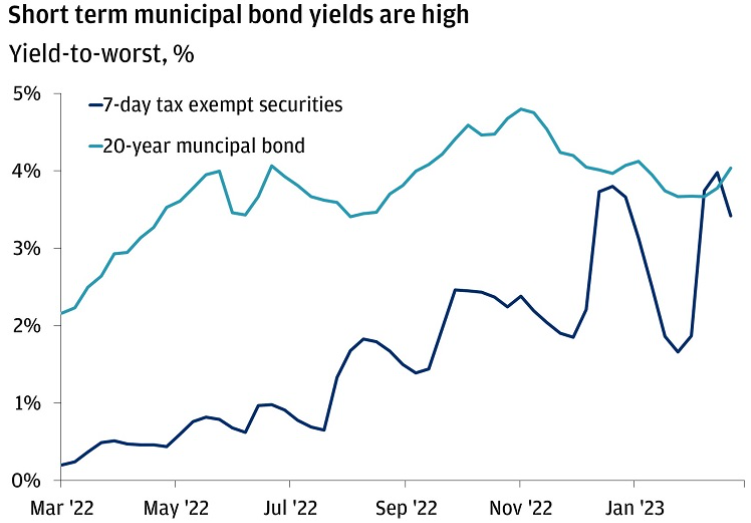

First there is yield to consider. The municipal SIFMA index—which looks at yields on seven-day tax-exempt bonds—has hovered around 3.4% to 4% over the last year. This chart from J.P. Morgan shows the recent climb in these securities.

Source: J.P. Morgan

The important thing to remember is this yield is tax-free. So, investors are looking at an after-tax equivalent yield about 6% for those in the top tax brackets.

Second, there are reinvestment risk benefits. For investors willing to go slightly further out on the curve, say one to two years in maturity, investors can lock in high yields for when the Fed starts cutting rates. Cash will feel the effects of rate cuts first, quickly falling. However, by locking in slightly longer maturities, investors can score higher yields for longer.

Then we have the tax angle. For an investor in the top tax bracket of 35%, placing a $50,000 investment in municipal bonds yielding around 3% would save over $500 in federal taxes annually.

Going Short With Your Munis

The question is: How should investors go about getting short with their munis and replacing their money market funds with these investments? There are two considerations.

For those who need absolute liquidity of cash, Variable Rate Demand Obligations (VRDOs) could be the option. VRDOs have a variable coupon that adjusts to changes in interest rates every seven or 35 days. VRDOs have the ability to be ‘put’ back and redeemed early by investors. This allows them to be fully liquid and, as such, they form the basis of many muni money market funds.

For those investors looking to lock in yields with plenty of liquidity, short-term and low-duration muni bonds could be best. Again, these bonds feature maturities of less than two years. Often, these are regular munis with 20- or 30-year maturities nearing the end of their life cycles. Additionally, some larger state governments issue shorter-term munis.

The win for these bonds is they often don’t bounce around and aren’t as interest rate sensitive. Because they only have a few months or a year left to ‘live’, investors don’t sell them as much as longer-dated bonds when the Fed raises rates nor do they buy them with absolute fervor when the Fed cuts. This steady-eddy nature makes them ideal as cash substitutes.

Building Your Short-Term Muni Bond Portfolio

There’s nothing you can do about 2023’s taxes. If you held cash, you’re going to get hit with a 1099 form for last year. But we can save on 2024’s tax bite. By swapping some cash for short-term muni bonds, investors can have the benefits of yield without the tax headache.

As with most muni bonds, the shorter end of the curve is very hard to purchase individually. As such, it makes sense to use funds to do your heavy lifting. For those who need liquidity, there are now several short-term muni bond funds that focus on VRDOs. Likewise, numerous fund companies offer muni money market funds, which provide liquidity and feature these bonds prominently.

At the same time, there are numerous short-term muni bond funds that step out a bit on the yield curve. Here, investors can lock in yield and still have plenty of safety/liquidity.

Short-Term Municipal Bond ETFs

These funds are selected based on exposure to short-term munis, both VRDOs and those with maturities of less than two years. They are sorted by their one-year total return, which ranges from 0.90% to 3.70%. Their expense ratio ranges from 0.07% to 0.55%, while they have AUM between $37M and $9.11B. They are currently yielding between 1.5% and 3.4%.

| Ticker | Name | AUM | 1-Yr Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| MEAR | BlackRock Short Maturity Municipal Bond ETF | $622.56M | 3.7% | 3.4% | 0.25% | ETF | Yes |

| JMST | JPMorgan Ultra-Short Municipal ETF | $2.62B | 3.2% | 3.3% | 0.18% | ETF | Yes |

| SMMU | PIMCO Short Term Municipal Bond Active ETF | $567.72M | 3.1% | 3.1% | 0.35% | ETF | Yes |

| PVI | Invesco Floating Rate Municipal Income ETF | $37.2M | 2.7% | 2.8% | 0.25% | ETF | No |

| FSMB | First Trust Short Duration Managed Municipal ETF | $410.48M | 2.1% | 2.6% | 0.55% | ETF | Yes |

| SMB | VanEck Short Muni ETF | $262.11M | 2.1% | 2.2% | 0.07% | ETF | No |

| SUB | iShares Short-Term National Muni Bond ETF | $9.11B | 1.7% | 1.9% | 0.07% | ETF | No |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.9B | 0.9% | 1.5% | 0.20% | ETF | No |

In the end, short-term munis offer many of the benefits of cash and cash-like holdings without the tax hassles. With interest rates still set to be high in the new year, investors holding cash may want to consider them for their portfolios.

The Bottom Line

With yields on cash surging to 5% this year, investors are getting something they haven’t had to think about in a long time: taxes. But short-term municipal bonds could offer a reprieve from the tax bite. Their high yields, liquidity and tax-free nature offer a solution to high cash balances. Using them for our portfolios makes a ton of sense.